Would you believe that the Magic Kingdom of Disney would not exist if Walt didn’t have a well-funded Whole Life insurance policy?

Walt Disney’s Whole Life policy acted as his own personal bank to provide the necessary liquidity to fund his dream. At the time it was a vision that only he could see, but one that the masses from around the globe would someday enjoy.

There are countless other stories of famous entrepreneurs who have essentially used the cash value in their life insurance policies to help with these 3 common phases of business:

- Starting their business

- Growing their business

- Or saving their business.

Click the appropriate option below to read about:

- A highlight reel with 3 of the most famous historical entrepreneurs who have used their life insurance as their own private bank

- Or first understand the reasons why life insurance is the ideal asset class for business owners

Click one of the options above or continue reading below.

Why Entrepreneurs Want Life Insurance as their Own Bank

Guaranteed Liquidity

Since entrepreneurs can achieve astronomical growth rates inside their own business, they put a premium on liquidity, access, and control. This is why most of them choose to forgo a reasonable rate of return when hoarding their cash in traditional bank accounts.

Many entrepreneurs don’t understand that their equity in permanent life insurance can be structured to be completely accessible inside their policy from inception without:

- Age restrictions

- Credit checks

- Auditing financial statements

- Needing to validate your reasons

You can even just withdraw your cash value from the policy without borrowing if you want. However, since policy loans keep your full balance compounding for you even while you borrow, the math shows that borrowing against your growing cash value can be much more financially efficient than paying cash for the exact same expenditure.

This is especially true since life insurance loan terms by law are the most flexible terms you can find.

Note: Certain policies today also give you the ability to lock in policy loan rates at 5%-6% FOR LIFE right now! Try asking your banker to do that for you.

Safe Growth

Even though your main wealth creation strategy is your business, why have your cash sitting dead while banks reap a ton of profit from your liquid reserves? What if it didn’t have to be an either/or conversation?

Certain life insurance policies credit your policy equity with:

- Steady growth in the 4%-5% range even in today’s low interest environment.

Other types of policies give you the opportunity to earn:

- Annual crediting in the 11%-13% range during strong bull market years without the risk of market losses in bear market years.

Either way, these policies grow on your behalf even when borrowing against your policy equity to infuse your business with capital. We understand that liquidity is the life’s blood of nearly every entrepreneur’s endeavors, whether it be some much-needed cash when juggling jobs in between receivables, or funding the next growth initiative for your company.

What if your cash reserves could be doing double duty for you? Most business bank accounts are like lazy employees sitting around watching the clock.

What if you could transform said clock-watchers into your star performers simply by moving them into a different office? With a few strokes of the pen and a health exam, you can re-energize your cash by moving it to a new location.

Tax efficiency

Ordinary income and capital gains taxes can erode anywhere between 15%-55% of an asset’s growth. Plugging these leaks would be equivalent to picking up extra growth without taking on extra risk or contributing additional capital.

Using government-endorsed retirement plans like IRAs, 401(k)s, profit sharing, and pension plans may help to avoid or postpone these taxes until retirement, but all of these plans will impose a 10% tax penalty if you need access to your capital before age 59.5.

Don’t a lot of your financial goals come before you turn 59.5?

If structured properly, your banking life insurance policy is treated almost exactly like a Roth only without the age 59.5 restrictions for accessing your growth. If you and your spouse make over $190,000 per year, you can’t even contribute to your Roth IRA. Not so with life insurance. There are no income restrictions for contributing to your permanent life insurance policy. Quite the contrary actually, you are also allowed to put in much more into life insurance than the IRS mandated $5,500 or $6,500 annual contribution limits.

Do you think tax rates will rise in the future? If so, you’ll probably want an account that gives you:

- Tax-sheltered growth

- Tax-exempt distributions before or during retirement

- Tax-free death benefit

Additional Benefits

What’s your biggest asset? … Your business, right? … The people, namely you and some other key players, correct?

What if your business was entitled to 6-7 figures of tax-free cash if any of these key players died.

What if there was a tax-free cash infusion if any of them got chronically ill or critically injured either while on the job or at home?

You may already be spending non-deductible dollars for this kind of insurance, but those premiums you pay start growing on the insurance company’s financial statement instead of your own. What if by simply parking your cash reserves and funneling your cash flow through one of these accessible insurance policies, you picked up this kind of protection as a ride-along?

It’s totally possible to have $1 wear multiple hats with a properly structured life insurance policy. This is one of the reasons why big banks and other major corporations funnel billions of dollars into this type of life insurance.

Rather than have your buy-sell and key man insurance show up as an expense on your P&L, why not have it show up as a multi-faceted asset that’s totally accessible on your balance sheet?

Highlight Reel with 3 of the Most Famous Historical Entrepreneurs Who Have Used their Life Insurance to:

- start their business

- grow their business

- or save their business

Let’s get back to Disney. I’m talking about the one and only Walt Disney.

Walt was trying to start his business but had a very difficult time getting banks to partake in his vision of a cartoon mouse and duck that would bring in the masses from around the world. The Disneyland Source Book quotes Walt as saying, “I could never convince the financiers that Disneyland was feasible because dreams offer too little collateral.”

Thankfully, he had previously built his own bank using Whole life Insurance. The Disneyland Source Book later goes on to say, “Unfettered [Walt] borrowed against his life insurance and sold his second house just so he could develop his idea to the point where he could show others what he had in mind. Studio employees worked on the project paid from Walt Disney’s personal funds.”

Because Walt Disney had this guaranteed access to liquidity, he was able to eventually capitalize on his dream and create a multinational empire for generations to enjoy.

During those lean years, however, his policy’s cash value continued compounding for him despite the loans needed to fund his vision. Not only that, but his policy continued to provide valuable protection for Disney’s family since without him, profits from his dream would have certainly never come to fruition.

On to the next iconic entrepreneur…

Ray Kroc was a man determined to grow his business from a quality local hamburger shack to a national pastime and household name.

If you saw the movie, The Founder, starring Michael Keaton, then you know that success didn’t happen overnight for Ray Kroc. In fact, he didn’t take a personal salary for the first 8 years so that he could preserve precious cash flow. Ray was determined to invest those dollars where he had the highest growth potential, his business.

It’s documented that Ray Kroc borrowed against two different cash value life insurance policies to pay his key employees along the way. He also funded McDonald’s hallmark branding campaign using the precious liquidity provided by his whole life insurance policy. Ronald McDonald was born because Ray Kroc was able to acquire funds at any time for any reason from his own private family bank.

With Ray Kroc, nobody knows for sure how astronomical the rate of return of that policy loan actually was. However, we all know about the billions upon billions of customers that McDonalds Restaurants have served since then. This is a direct result of that key early growth that was largely self-funded by Ray Kroc’s whole life insurance policies.

Let’s now discuss how using whole life insurance as an emergency fund helped one very well-known entrepreneur save his family business empire from the tailspin of the Great Depression.

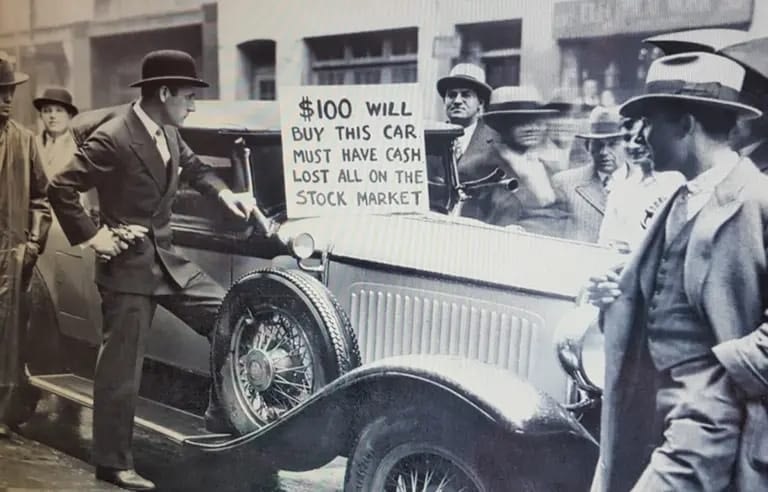

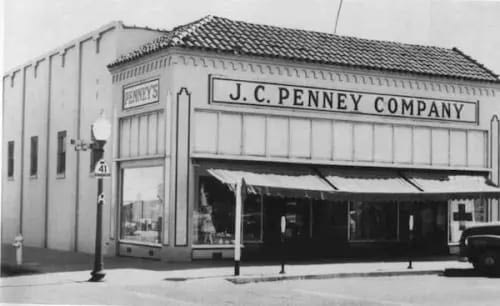

J.C. Penney had his chain of department stores on auto-pilot and cash-flowing nicely during the boom of the Roaring 20’s. It was the quintessential American dream fulfilled. Like most business owners at this stage of prosperity, Mr. James Cash Penney diversified into a vast stock portfolio as well as acres upon acres of Florida Real Estate.

Perhaps the least exciting of all his investment choices was a very large Whole Life Insurance policy, with its conservative but steady growth rate. As a responsible employer and head of household, it’s likely that Penney got the policy more for the death benefit component than for the cash value component.

Regardless of why he bought it, his Whole Life insurance policy quickly became his favorite asset class after the Stock Market crashed in 1929. The Great Depression ensued. Real estate tanked, especially overvalued Florida real estate. Banks failed by the dozens as the masses came in demanding their deposits back.

However, there are much stricter reserve requirements placed upon life insurance companies than on banks. Many of the prominent life insurance companies of the time actually participated in bailing out the banking industry. These ultra-conservative life insurance companies were therefore in a very enviable position in terms of liquidity, and so were their Whole Life policyholders.

Thanks to the contractual growth and guaranteed liquidity inherent in a whole life insurance policy, I guess you could say that life insurance companies also bailed out J.C. Penney during the Great Depression.

Around the same time that the crash hit, James Cash Penney’s health was starting to give way, probably due to the stress of the situation. How reassuring it must’ve been for J.C. to know that even though he took a large loan against his cash value to save his business, there would still be a substantial death benefit paid out to his family if he were to pass away during that tumultuous time.

Thankfully Mr. James Cash Penney was able to right the ship with his health and also with his most valuable asset: his business. That much-needed cash infusion from his Whole Life Insurance policy provided the necessary liquidity to continue purchasing inventory and paying salaries to keep the doors open long enough to recover.

Although it took nearly 20 years for the stock market and the real estate market to recover, J.C.’s chain of department stores survived as they continued to provide dry goods to the masses as the American people emerged from the Great Depression. James Cash Penney supported his family and many others because his business provided a way to make a living during lean times.

His company eventually went public, creating a multi-generational family legacy due mostly to the rock-solid guarantees of one of the safest and steadiest asset classes available to entrepreneurs,

In Conclusion

There is enough risk that comes with being a business owner, so having a dependable asset class to safely store funds is crucial. Although banks claim they are our only safe-haven, we can learn from the insurance companies that once bailed them out and also from the great entrepreneurs of the past that there is indeed a better way.

The evidence is in how the banks themselves safely store billions of dollars of their cash reserves in cash-rich life insurance policies on their key executives. If you haven’t already, watch this 4-minute video on how big banks themselves use life insurance as one of their primary holding tanks for safe and liquid reserves.

You can also watch this 6-minute video on how you can use your own properly-funded life insurance policy as your own private bank to invest in your business and/or real estate.